Stocks • Futures • Forex • News & Information

PitNews.com

Track ‘n Trade Live Review

strategy back-testing and

feel comfortable with the

performance of your

strategy, the last step is to

go live and let the Track ‘n

Trade software start

automatically executing

your trades’ strategies,

which can be done in both

your real-money account

and you simulated trading

account.

One of the best things

about the Autopilot Plug-in

is that it is very easy to

operate. Unlike many of

the other automated

trading systems, the

Autopilot Plug-in for Track

‘n Trade does not require

any computer

programming, which means that

practically anyone should be able to

quickly start implementing their trading

ideas.

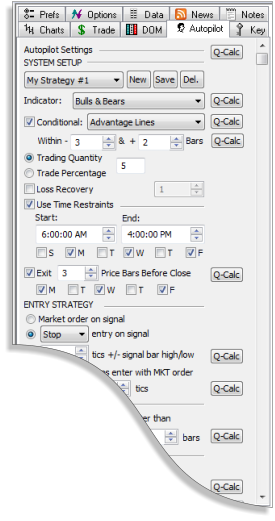

Lastly, the Autopilot Plug-in is completely

customizable, allowing you to specify multiple

different Autopilot settings, which includes both

indicator settings and entry/exit settings. For example, you

are able to specify the settings of the

technical indicator(s) being used in

your Autopilot trading system (you are

able to specify up to two indicators,

where one indicator is the “primary”

indicator and the other indicator is the

“conditional” indicator), the times that

you want your system to trade (which

includes the time of the day and the

days of the week), and the type of

order that is placed (i.e., limit order,

stop order, trailing stop, jump stop,

etc.). If you aren’t sure what setting is

the best and would like to select the

settings that had the best performance

over your analysis period, the

Autopilot Plug-in has a “Q-Calc” button

(“Q-Calc” stands for “Quick

Calculation”) that will quickly optimize

most of the various Autopilot system

settings.

Candlestick Auto-Recognition Plug-in

The Candlestick Auto-Recognition Plug-in automatically

recognizes multiple different candlestick chart patterns (ranging

from the Harami pattern to the Evening Star pattern), quickly

highlighting those patterns so that you don’t have to spend time

looking for them. Since the size the candlestick that is needed

for certain candlestick patterns can vary, depending on which

market you are analyzing, each of the candlestick patterns has

user-definable settings that allow you to specify exactly what

you are looking for. Additionally, the Candlestick Auto-

Recognition Plug-in is fully integrated with the Autopilot Plug-in

so you are able to select your favorite candlestick pattern and

place trades automatically as soon as it occurs. This also means

that you are able to use the “Q-Calc” button to find what

candlestick setting had the best performance over your analysis

period, which is a great feature to have when you aren’t

completely sure which setting has had the best performance,

historically.

Seasonals Plug-in

The Seasonals Plug-in is used to determine the seasonality of

the markets that you trade and it includes the Seasonal Trend

indicator window, Market Probability indicator window, and the

Historical Averages chart overlay. The Seasonal Trend indicator

window gives you the ability to quickly determine the seasonal

bias of the markets that you are trading. You are able to quickly

compare the current price action of the market to its own

historical average price action (i.e., seasonal price action), in

order to help you make more informed trading decisions. The

Market Probability indicator window, on the other hand, displays

the historical directional probability of the market that you are

trading (i.e., the historical probability that a given trading day

will be either bullish or bearish). Lastly, the Historical Averages

chart overlay is a chart overlay that displays the average

historical price in the same window as the price bars so that you

are able to compare the current price to the average historical

price. The Seasonals Plug-in is only available for daily charts.

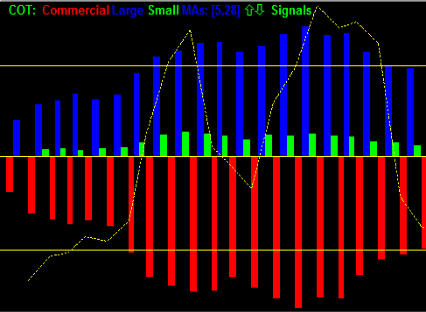

Commitment of Traders Plug-in

The Commitment of Traders Plug-in gives you an idea of what

each of the main groups of market participants (i.e. Large

Speculators, Commercial Traders, and Small Speculators) are

buying and selling by displaying a color-coded histogram that

shows you the “volume direction” of each group, helping to

identify volume and position changes from one period to the

next. This plug-in is completely customizable, letting you specify

exactly how you would like both the Commitment of Traders

indicator window and the Commitment of Traders buy and sell

indicator arrows displayed. Although The Commitment of

Traders Plug-in is now available in both Track ‘n Trade futures

applications, Live and EOD, the CFTC only provides data for

end-of-day charts.

Track ‘n Trade Live Trading Platforms and Charting Software are

offered as a free 14-day trial. Click Here to learn more.

by: Kent Koefoed, Mr. Koefoed is a market technician and

research analyst for Gecko Software, Inc.

Gecko Software, Inc.

271 N Spring Creek Pkwy Ste A

Providence, UT 84332 USA

Phone:

1.800.862.7193 -- 435.752.8026

Email:

gecko@geckosoftware.com

Website:

www.TracknTrade.com (Product Site)

Product:

Track ‘n Trade LIVE, Stocks, Futures & Forex Live

Trading and Charting Platforms.

Requirements: MS-Windows, 500 MB free hard disk space,

1024x768 screen resolution (minimum) Larger recommended.

RAM 2GB (more is better). Requires Internet connectivity for

live trading and streaming market data, CPU: 2.4 GHz, higher

recommended.

Price: $297.00 (Plus small monthly data subscription fee which

also includes all future updates to the software platform.)

--------------------------------------------------------------------

by Kent Kofoed

--------------------------------------------------------------------

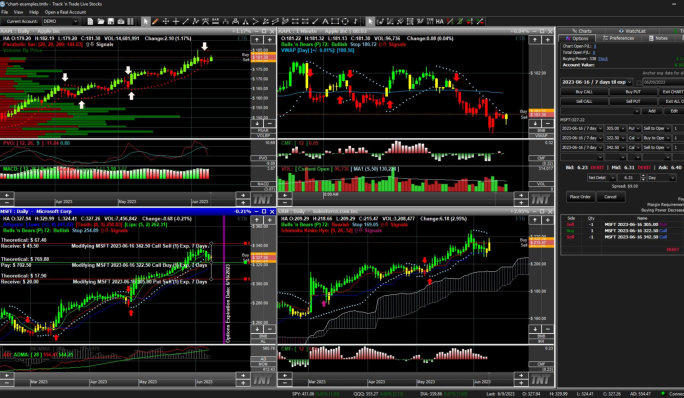

There are three different versions of the Track ‘n Trade Live

trading platform, and charting software, which includes Track ‘n

Trade Live Futures, Track ‘n Trade Live Forex and Track ‘n Trade

Live Stocks, where each version of the software is its own

individual trading platform.

When logging in to Track ‘n Trade Live, you have the option of

logging into a “real” account or a “demo” account. The “real”

account option logs you into your real-money trading account

and will allow you to place real-money trades, whereas the

“demo” account option logs you into your simulated trading

account and will allow you to place simulated trades. Lastly, in

order to help you get started, there is a wealth of education to

help you get up-to-speed in no time.

Once you are ready to start analyzing charts and researching

potential trades with Track ‘n Trade Live, you will be able to

back test your strategies with large historical databases and

then make trading decisions with live streaming data. Track ‘n

Trade Live also has multiple different charting options, where

you can select from any increment of one minute charts, plus,

daily charts, weekly charts, monthly charts and range charts,

and this is just one of the many ways that Track ‘n Trade Live is

highly customizable. Other ways that you are able to customize

the platform include selecting from more color options that you

could possibly imagine, choosing your favorite type of price bar

(e.g., OHLC, HLC, close, open, and

candlestick), scaling each individual

chart horizontally and vertically (or

simply selecting the “autoscale” option),

adding or removing buy/sell indicator

arrows, and basically every other

software feature customization that you

could possibly need.

After you have decided which trade to

enter into, you will be able to place your

order (real-money or simulated) with

the Track ‘n Trade Live Drag ‘n Drop

order placement, where you can select

from either a limit order, market order

or stop order. Once your order is filled,

closing out your position is just as easy

as it was to enter into your position

(i.e., you can also use the Drag ‘n Drop

order placement feature to place a sell

order, which can also be either a limit

order, market order or stop order), and,

if you need to exit your positions more

quickly, you also have the ability to exit

all of the open positions for the current

chart or exit all open positions within an

individual Track ‘n Trade Live platform.

In addition to LIVE Futures, LIVE Forex and LIVE Stocks, there

are also LIVE Options (Futures), which can either be used to

increase leverage or to manage risk. In addition to LIVE

Options, the Track ‘n Trade Live platform also has multiple

specialty plug-ins, which includes the Bulls ‘n Bears Advantage

Plug-in, Autopilot Plug-in, Candlestick Auto-Recognition Plug-in,

Seasonals Plug-in and Commitment of Traders Plug-in.

Track ‘n Trade Live Plug-ins:

Bulls ‘n Bears Advantage Plug-in

The proprietary Bulls ‘n Bears Advantage Plug-in includes both

the Bulls ‘n Bears indicator and the Advantage Lines indicator.

The Bulls ‘n Bears indicator is a color-coded indicator that

changes the price bars to either red (bearish), yellow (neutral)

or bullish (green), and displays both bullish and bearish

indicator arrows, identifying both entry and exit points,

respectively. The Advantage Lines indicator is an indicator that

uses two “Advantage Lines” to identify entry and exits points

(based on two customizable period settings), which are

displayed with buy and sell arrows, respectively.

Autopilot Plug-in

The Autopilot Plug-in gives you the ability to design, back-test,

and execute automated trading strategies within the Track ‘n

Trade Live platform. When designing your strategy, you are able

to choose from multiple different technical analysis indicators,

including the Bulls ‘n Bears indicator and the Advantage Lines

indicator (assuming that you already have the Bulls ‘n Bears

Advantage Plug-in), as well as set your own entry and exit

specifications (which includes limit orders, stops orders, trailing

stops, jump stops, etc.). After you have designed your strategy,

you are then able to back-test your strategy using historical

price data, in order to see how your strategy would have

performed in the past. Once you have completed all of your

5 Star Rating

Copyright © PitNews Press, All rights reserved

*Trading financial instruments, including Stocks, Futures, Forex or Options on margin, carries a high level of risk and is not suitable for all investors. The high

degree of leverage can work against you as well as for you. Before deciding to invest in any of these financial instruments you should carefully consider your

investment objectives, level of experience, and risk appetite. Only risk capital should be used for trading and only those with sufficient risk capital should consider

trading. The possibility exists that you could sustain losses exceeding your initial investment. You should be aware of all the risks associated with trading and seek

advice from an independent financial adviser if you have any doubts. Past performance, whether actual or hypothetical, is not necessarily indicative of future

results. All depictions of trades whether by video or image are for illustrative purposes only and not a recommendation to buy or sell any particular financial

instrument. See full risk disclosure