Deion Mitchell

Behind the Trades:

Deion’s Approach to Options

Claire Kristensen

Mastering The Christmas Tree

& Balaam’s Ladder Strategies

Magazine

December 2023

PitNews

Your Trusted Source for Trading Intelligence: www.PitNews.com

Dear Friend,

As the festive season approaches, we at PitNews Magazine extend our warmest

wishes to each of you for a merry Christmas and a joyous holiday season. Your

continued subscribership and engagement with our content is a deeply cherished gift.

In this special holiday edition, we've prepared a selection of articles that promise to

enlighten, educate, and entertain. Our lineup includes:

1.

"How I Take Profits: Why Doesn't Anyone Take Money Out?" by Claire

Kristensen, delving into the art of realizing profits in trading.

2.

"The Intricate World of Technical Analysis" by Aiden Gray, exploring the

nuances of chart patterns in financial trading.

3.

"Behind the Trades: Deion Mitchell’s Approach to Trading Options" by Deion

Mitchell, offering his insights into the dynamic world of options trading.

4.

"Mastering The Christmas Tree and Balaam’s Ladder Trading Strategies" by

Claire Kristensen and Aiden Gray, presenting two innovative strategies.

5.

"The Great YouTube Trader: Don't Get Bamboozled" by Lan Turner, a critical

examination of online trading gurus and their tactics.

6.

We also have a special treat - a heartwarming poem by our very own poet

laureate, Gideon P. Thornfield, whose words capture the essence of the

season. Also, don’t miss out on our Christmas crossword puzzle, a delightful

holiday challenge.

As we celebrate this joyous time, we invite you to share the spirit of PitNews

Magazine with friends and loved ones. Your recommendations are invaluable in

helping us grow our readership and community.

Thank you for being part of our journey this year. Here's to a season filled with

warmth, happiness, and successful trading!

Best Wishes,

Lan H Turner, Editor-in-Chief

PitNews Magazine

Editor's Notes: December

Table of Contents:

Your Guide to Mastering the Markets

How I take Profits: Why Doesn’t Anyone Take Money Out?

by Claire Kristensen: Page 5

In this article, Claire Kristensen delves into the often overlooked practice of taking profits in

trading, challenging the norm of continual reinvestment. She shares her unique strategy,

which emphasizes the joy of reaping investment rewards, akin to harvesting the fruits of a

well-tended garden.

The World of Technical Analysis: Let’s Dive Into Chart Patterns

by Aiden Gray: Page 9

This article by Aiden Gray delves into the complex world of technical analysis in stock

trading, focusing on the interpretation of chart patterns like Triangles, Wedges, and Head

and Shoulders. Gray explains how these patterns provide insights into market trends and

investor behavior, equating the skill of reading them to navigating through the

unpredictable world of financial markets.

Deion Mitchell’s Approach to Trading Options

by Deion Mitchell: Page 18

Deion Mitchell shares his insights on the versatility and strategic complexity of options

trading. He highlights how options allow for tailored strategies suited to any market

condition. Mitchell emphasizes the dual nature of options: they can serve as high-risk, high-

reward investments or as protective hedges in volatile markets, underscoring their appeal

and utility in a trader's portfolio.

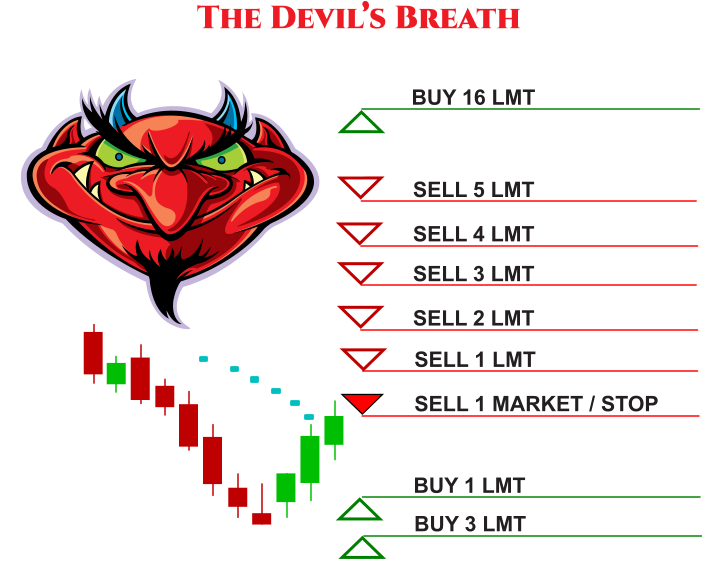

Mastering The Christmas Tree and Balaam’s Ladder

by Claire Kristensen and Aiden Gray: Page 27

Claire Kristensen and Aiden Gray explore the Christmas Tree and Balaam's Ladder trading

strategies in their collaborative article. These methods utilize a hybrid form of dollar cost

averaging to strategically navigate market fluctuations: The Christmas Tree for buying in

downturns, and Balaam's Ladder for shorting in rising markets, both emphasizing

incremental investments over aggressive full-position entries.

The Greatest of All YouTube Traders: Don’t Get Bamboozled

by Lan Turner: Page 33

Lan Turner critically examines the rise of YouTube as a platform for trading advice. The

article warns of the deceptive practices of some trading "gurus" who create an illusion of

infallible success through editing tricks and selective reporting. Mr. Turner emphasizes the

importance of discerning genuine trading skills from misleading performances and

educates readers on spotting red flags like lack of transparency and inconsistency.

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

How I Take Profits:

Why Doesn’t Anyone Take Money Out?

By Claire Kristensen

When I first dipped my toe into the vast ocean of

trading, I was struck by an odd practice among

investors: they were constantly feeding the market

with fresh funds, yet seldom did they seem to ever

withdraw their profits. It was as if they were tending

to endless orchards without pausing to taste the fruit.

This realization sparked a question in me: wasn't the

point of investing to eventually reap the rewards?

With fresh eyes and a beginner's curiosity, I was

brimming with questions and a keen desire to learn.

I quickly noticed how everyone seemed so focused

on growing their investments. Yet, few talked about

the moment of reward—taking profits.

Lan Turner's suggested method of a disciplined, long-

term investment strategy—planting $100 weekly for

five or more years and then reaping the same

amount weekly for ten, or more—was prudent. But

still, I yearned for a quicker return, a more

immediate celebration of my efforts.

So, I developed a strategy that wasn't just about

watching numbers climb but was also about

enjoying the returns. For me, I think of my trading

account as a garden where I don't just tend to the

plants but also enjoy the fruits of my labor. It was a

straightforward plan, really: invest wisely, wait

patiently, and when the time is right, savor the

success.

I began with what at the time felt like a significant

amount of money—$10,000—planted into the fertile

ground of the QQQ, a fund teeming with the tech

world's giants.

Page 5

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

I chose a different rhythm, unlike the steadfast 'buy

and hold' approach. Every three months, I would

wander through my financial garden, basket in

hand, ready to gather any growth that had sprung

from my investment.

If my garden flourished, I joyfully collected the

surplus. If not, I would wait, knowing that not every

season is bountiful. And here's the crucial part—I go

and enjoy it. That's right. OMG, I know, I break the

cardinal rule of investing. I spend my profits; I splurge

on something I've had my eye on.

My approach isn't solely focused on accumulating

wealth; it's about relishing the rewards as they come.

Much like life, the true pleasure in investing lies

within the journey, not just the destination—after all,

we can't take it with us in the end.

As time passed and my garden remained fruitful, I

found myself at a crossroads.

So, I adapted. Instead of resetting my garden to its

original size each quarter, I began to let it grow,

pruning only half the profits and allowing the rest to

thrive. This subtle shift meant that my garden slowly

expanded, promising more abundant future harvests

while still letting me savor the present bounty.

As my confidence in trading grew, I began to think

about diversification. Why not start with a

foundation of stability but also sprinkle in the

excitement of high-potential? Perhaps a mix of

individual opportunities, balancing steady

performance with the promise of more rapid growth.

I started by planting half in the QQQs and the rest in

individual high-growth stocks and ETFs. Then, I

harvest from only the individual

investments, often finding that my

diversified crops bring a more

plentiful yield than had I relied on

the single index fund alone.

For me, this journey through the

markets has been about more than

just accumulating wealth; it's been

about finding a balance that honors

both the present moment and my

future aspirations. It's about

recognizing that the harvest is not

just an end goal but a vital part of

the growth cycle.

To those pondering their next step, I

say: envision your investment as a

garden. Care for it, watch it grow,

but most importantly, when the

time is ripe, relish the harvest. For me, that timeline

is quarterly, Christmas, and birthdays. If we don't

take the time to enjoy the fruits of our endeavors,

we must ask ourselves what purpose they truly serve.

Don’t be a Christmas Scrooge, withdraw some

money and go buy something for someone you love.

Try it; it feels good.

Page 6

The Fibonacci Effect

Now on Amazon!

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 7

Lan Turner’s Stock Market

Playbook of Strategies

•

Gain Discipline and Courage

Through Knowledge & Strategy.

A 238-page workbook. Your manual to

the stocks, futures, and options markets.

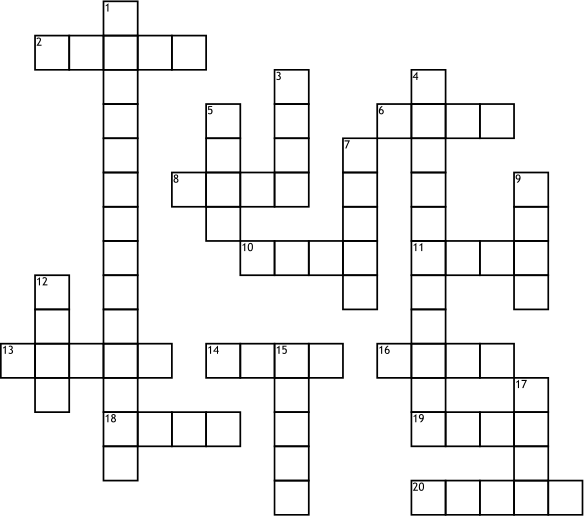

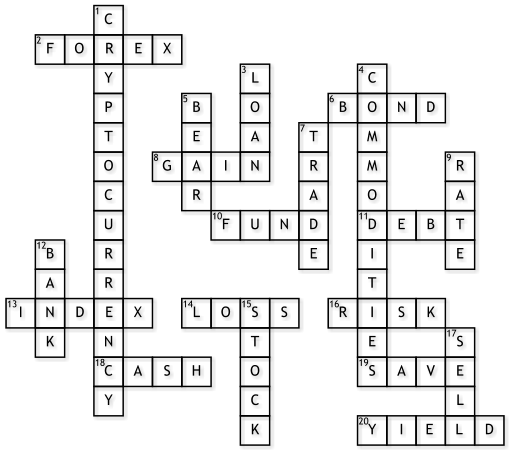

Across

2.

Global market where currency

is excha

nged.

6.

A formal promise to

pay,

issued by governments or

corporations.

8.

When your investment bares

fruit, it's you

r...

10.

A collective pot of

money

to

grow a diversified in

vestment

.

11

.

A financial sha

dow loo

ming

until repaid.

13

.

A financial barometer,

gauging the health of

the stock

mark

et.

14

.

An unfortunate reduction

in

your po

rtfolio.

16

.

Venturing into pote

nt

ially

profitable

but uncer

tain

territories

.

18

.

The most liquid transa

ction

form, a

lways r

eady.

19

.

The act of storing money

.

20.

Earnin

gs fro

m your

investments.

Down

1.

A digital or virt

ua

l currency.

3.

Banker's charg

e you inte

rest

on the

se.

Page 8

4.

Raw materia

ls prim

arily

agricultural produ

cts

5.

Investors feel as

gr

um

py as this

forest dweller duri

ng

falling

price

s.

7.

The exchange of asset

s.

9.

The cos

t of bo

rr

owing mo

ney.

12

.

Where you keep your

checking and savin

gs.

15

.

It represents o

wning

a sma

ll

piece of a company.

17

.

The act of

transferring

ownersh

ip.

Answers: Page 41

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

by Aiden Gray

As I sit in my home office, surrounded by the tranquil

Arizona landscape, I'm reminded daily of the

parallels between the vast desert and the world of

financial trading. My name is Aiden Gray, and I'm a

day trader who's learned to decode the mysteries of

the stock market through technical analysis.

To me, the charts and graphs of the market are not

mere numbers and lines; they are a language of

their own. They speak of past market behaviors,

offering glimpses into future trends. Each day, as I

analyze the patterns formed by price movements

and volume, I feel like a navigator charting a course

through unpredictable seas.

In technical analysis, chart patterns have become my

most trusted guides. These formations, etched on my

screen, are more than abstract shapes. They hold

profound predictive power, telling stories of potential

reversals and continuations in the market.

Today, I want to take you through the intricacies of

Triangle and Wedge formations. These patterns are

not just elements of my trading strategy; they are

critical players in the narrative of market dynamics.

The Triangle, with its converging lines, often signals a

period of consolidation before a breakout. Though

similar in form, Wedge patterns speak of a different

fate, hinting at imminent reversals.

The Intricate World of Technical Analysis:

Let’s Dive Into Chart Patterns

Page 9

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 10

And then, there's the Head and Shoulders pattern –

distinct with its peaks and troughs, often signaling a

significant shift in market trends.

Join me on this journey as we delve deeper into these

patterns. Understanding their nuances is not just

about making predictions – it's about aligning our

strategies with the rhythm of the markets. Together,

we'll uncover the stories these patterns tell and learn

how to apply this knowledge in our trading

adventures.

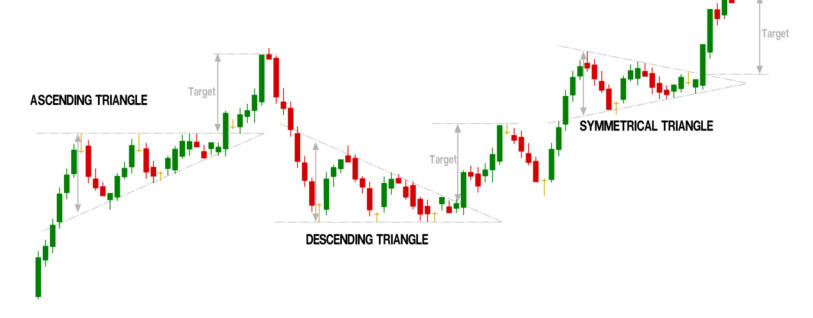

The Geometry of Market Sentiment: Deciphering

Triangle Formations

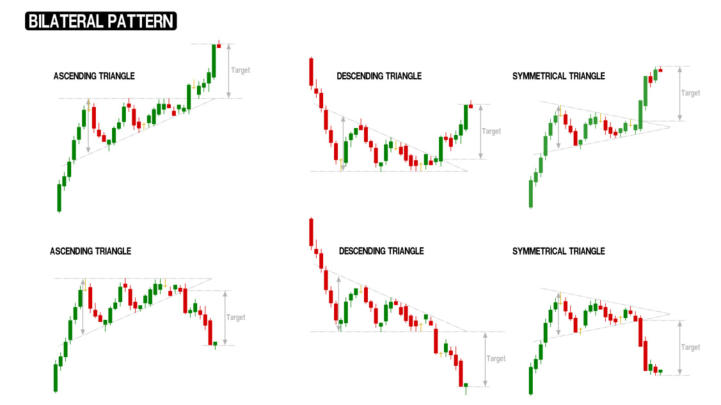

In the realm of technical analysis, Triangle

formations are revered as significant predictors of

future price movements. These patterns materialize

on price charts as the lines of support and resistance

converge, creating a triangle-like shape. This

convergence signals a period of consolidation - a

battleground where the forces of supply and

demand are almost in equilibrium, leading to a

suspenseful pause in the trend before a breakout.

Ascending Triangle: The Bullish Catalyst

•

The Ascending Triangle is a distinctly bullish

pattern, easily recognizable by its flat top

resistance line and an upward-sloping bottom

support line. This formation typically unfolds

during an uptrend, revealing that despite several

attempts, the price cannot surpass a certain

resistance level. However, the rising support line

indicates increasing buying pressure, suggesting

the resistance might eventually give way.

•

For traders, an Ascending Triangle is a

forerunner of potential upward momentum. The

repeated failure to break the resistance level

may discourage sellers, while buyers gather

strength. The culmination of this pattern often

leads to a decisive breakout above the

resistance, signifying the continuation of the prior

uptrend.

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 11

control, and the price moves within a tightening

range, leading to a vertex.

•

For market participants, the Symmetrical

Triangle is a sign of indecision. Unlike the

Ascending and Descending Triangles, it doesn't

inherently favor bulls or bears. The breakout

direction – upward or downward – is uncertain

until it occurs, making it crucial for traders to

wait for a clear breakout signal before taking a

position.

The Telling Slopes of the Market: Unraveling Wedge

Formations

Wedge formations, often considered cousins of the

Triangle patterns, play a pivotal role in technical

analysis. While they share a converging boundary

feature with triangles, their distinctive characteristic

lies in the direction of their sloping lines.

Descending Triangle: The Bearish Precursor

•

In stark contrast to its bullish counterpart, the

Descending Triangle is characterized by a flat

bottom support line and a downward-sloping

top resistance line. This pattern typically

develops during a downtrend, suggesting that

the price is repeatedly repelled by a certain

resistance level, while the support level holds.

•

Traders often interpret the Descending Triangle

as a prelude to further bearish movement. The

inability of the price to break through the

resistance level reinforces the dominance of

sellers. A bearish breakout usually occurs when

the price finally breaches the support level,

continuing the existing downtrend.

Symmetrical Triangle: The Market's Equilibrium

•

The Symmetrical Triangle is a more neutral

pattern, formed by the convergence of a

downward-sloping resistance line and an

upward-sloping support line. This pattern reflects

a period where neither bulls nor bears have clear

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 12

In Wedge formations, both the support and

resistance lines move in the same direction, either

upwards or downwards, creating a narrowing price

range. These formations are key indicators of a

potential reversal in the prevailing market trend.

Rising Wedge: The Prelude to a Bearish Turnaround

•

The Rising Wedge is a pattern formed when the

support and resistance lines ascend, with the

support line climbing at a steeper angle. This

pattern typically develops during an uptrend

but can occasionally appear in downtrends. The

narrowing of the price range indicates that the

uptrend is losing momentum, despite the higher

price.

•

In an ongoing uptrend, the rising wedge signals

the weakening of the bullish force. The eventual

breach below the support line is seen as a

confirmation of a bearish reversal. Traders often

view this pattern as a warning to prepare for a

potential downward shift in the market trend.

Falling Wedge: The Signal of a Bullish Resurgence

•

The Falling Wedge, conversely, is characterized

by both the support and resistance lines sloping

downwards, with the resistance line descending

more sharply. This formation is commonly seen

during downtrends but can also form during

uptrends. The contraction of the price range in

this pattern suggests that the downtrend is

running out of steam.

•

For traders, the Falling Wedge is a beacon of

hope in a bearish market. It indicates that selling

pressure is diminishing and a bullish reversal is on

the horizon. A breakout above the resistance line

often validates this pattern, signaling a shift to

an upward market trend.

Contrasting with the Head and Shoulders Pattern

Deciphering Peaks and Troughs: The Head and

Shoulders Perspective

While Triangle and Wedge formations offer insights

into market consolidation and potential trend

reversals, the Head and Shoulders pattern brings a

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 13

different dimension to chart pattern analysis. Known

for its reliability, this pattern is often considered a

forerunner of significant trend reversals.

Description of the Head and Shoulders Pattern

•

The Head and Shoulders pattern is characterized

by three distinct peaks on a chart. The central

peak, known as the 'head,' is the highest, while

the two surrounding peaks, or 'shoulders,' are

lower and approximately equal in height. This

pattern typically forms after an extended

uptrend, indicating exhaustion among buyers.

•

The Inverse Head and Shoulders, as the name

suggests, is the upside-down version of the

standard pattern. It features a central trough

flanked by two shallower troughs and usually

develops during a downtrend, signaling a

potential bullish reversal.

Differentiating Features from Triangle and Wedge

Formations

•

Unlike the converging lines of Triangle and

Wedge formations, the Head and Shoulders

pattern is distinguished by its unique 'M' or 'W'

shape. This structure is a result of specific price

movements - a rally to a new high (the first

shoulder), followed by a decline and a

subsequent rally to a higher high (the head), and

finally another decline and rally to a lower high

(the second shoulder).

•

While Triangles and Wedges indicate a

consolidation phase with a breakout potential,

the Head and Shoulders pattern specifically

signifies a reversal in the prevailing trend. It

highlights a critical shift in the market's

sentiment, from bullish to bearish or vice versa.

Interpretation of Standard and Inverse Head and

Shoulders Patterns

•

The standard Head and Shoulders pattern is

viewed as a bearish reversal indicator. It suggests

that after a prolonged uptrend, the market is

transitioning to a downtrend. The 'neckline,'

drawn by connecting the lowest points of the two

troughs, serves as a key level. A definitive break

below this line confirms the pattern, indicating a

sell signal.

•

Conversely, the Inverse Head and Shoulders

pattern signals a bullish reversal at the end of a

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 14

downtrend. A break above the neckline, in this

case, acts as a confirmation of the pattern,

indicating a buying opportunity as the market

sentiment shifts from bearish to bullish.

Harnessing Chart Patterns for Strategic Advantage

Recognizing and effectively applying chart patterns

like Triangles, Wedges, and Head and Shoulders in

trading can significantly enhance a trader's ability to

make informed decisions. The key to capitalizing on

these patterns lies not only in their identification but

also in understanding the market context in which

they appear.

How to Recognize These Patterns Early

•

Regularly analyzing charts helps in honing the

ability to spot these patterns early. Familiarity

with the typical appearance and structure of

each pattern is crucial.

•

Pay attention to the volume accompanying the

formation. For example, a true Head and

Shoulders pattern often exhibits declining

volume at the formation of the second shoulder.

•

Combine pattern analysis with other technical

indicators like moving averages or RSI (Relative

Strength Index) for confirmation. For instance, a

rising wedge might be accompanied by a

declining RSI, reinforcing its bearish implication.

Understanding the Context and Market Conditions

for Accurate Interpretation: The Broader Picture

•

Always evaluate chart patterns within the

broader market context. The historical trend,

market sentiment, and macroeconomic factors

can influence the effectiveness and reliability of

these patterns.

•

For example, an Ascending Triangle might have

a higher probability of a bullish breakout in a

strong bull market.

•

Market volatility can impact the formation and

interpretation of chart patterns. Be cautious

during highly volatile periods as patterns may

not adhere to typical expectations.

Incorporating Patterns into Your Trading Strategy

•

Use the patterns to determine strategic entry

and exit points. For instance, entering a trade

after a breakout has been confirmed and setting

a stop loss below the pattern's lowest point can

be a prudent approach.

•

Incorporate sound risk management practices.

No pattern provides a guaranteed outcome, so

it's vital to manage risk with proper position

sizing and stop-loss orders.

The Limitations of Relying Solely on Chart Patterns

•

While chart patterns are powerful tools, they are

not foolproof. False breakouts or breakdowns

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 15

are common, and patterns can sometimes lead

to misleading signals.

•

External factors such as economic news,

geopolitical events, and market sentiment can

dramatically influence the efficacy of chart

patterns. A pattern that forms ahead of a major

economic announcement might not follow the

expected outcome due to the impact of the

news.

Mastering the Art and Science of Chart Patterns

As we conclude our exploration of Triangle, Wedge,

and Head and Shoulders patterns, it's clear that

these chart formations offer valuable insights into

the market's pulse. However, their true power lies

not just in their individual characteristics but in how

they are integrated into a broader trading strategy.

Key Distinctions

•

Triangle Formations: These patterns, including

Ascending, Descending, and Symmetrical

Triangles, are primarily indicative of a

consolidation phase with a potential for

continuation or reversal, depending on their

structure.

•

Wedge Formations: Rising and Falling Wedges

signal impending reversals. Their unique sloping

lines, moving in the same direction, differentiate

them from Triangles.

•

Head and Shoulders Pattern: This pattern,

distinct with its three peaks, is a reliable indicator

of major trend reversals, differing from the more

neutral or continuation-oriented Triangle and

Wedge patterns.

The Synergy of Combined Analysis

As I sit back in my chair, reflecting on the lessons the

market has taught me, I realize that the true

mastery in trading comes from a harmonious blend

of different analysis methods. It's like looking at the

desert through different lenses--each perspective

adds depth to the overall picture.

In my journey as a trader, I've learned that relying

solely on chart patterns like Triangles, Wedges, or

Head and Shoulders is akin to navigating by the

stars alone. Yes, they provide guidance, but it's the

synergy with other tools that truly charts the course

to success. Incorporating fundamental analysis brings

in the broader economic view, like understanding

the terrain. Paying attention to market sentiment is

like feeling the wind's direction--it tells you what

other traders are thinking and expecting.

But it's not just about blending different methods. It's

about understanding that this combination enhances

risk management, like a seasoned traveler who

knows to carry both a compass and a map. This

synergy doesn't just increase my chances of successful

trades; it also helps me navigate through market

uncertainties with a balanced approach.

So, as I share these insights with you, remember that

the art of trading is not just about predicting the

next move. It's about combining the wisdom of chart

patterns with the insights from various analysis

methods. This approach empowers us to make

informed decisions, not just as traders but as wise

navigators of the financial markets. Our goal is not

merely to foresee market movements but to journey

through them with confidence and wisdom, much

like a traveler who respects the Arizona desert's

vastness yet knows his way through it.

Aiden Gray is an avid full-time trader living in Sedona,

Arizona. He specializes in day trading futures and

stock options with Track ‘n Trade Live. Aiden is a

member of Lan Turner’s President’s Club and a

contributing writer to PitNews Magazine.

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 16

•

Ascending Triangle: A bullish chart pattern

characterized by a flat top resistance line and an

upward-sloping bottom support line, indicating

a continuation of the uptrend after a breakout.

•

Bearish: A term used in trading to describe the

expectation that a market, asset, or price will

decline.

•

Bullish: A term used in trading to describe the

expectation that a market or price will rise.

•

Chart Patterns: Distinct formations created by

the fluctuations in price on a chart, used by

traders to predict future market movements.

•

Descending Triangle: A bearish chart pattern

characterized by a flat bottom support line and

a downward-sloping top resistance line,

indicating a continuation of the downtrend after

a breakout.

•

Falling Wedge: A bullish chart pattern where

both support and resistance lines slope

downwards, with the resistance line falling more

sharply, indicating a potential reversal from a

downtrend to an uptrend.

•

Fundamental Analysis: A method of evaluating

a security to measure its intrinsic value by

examining related economic, financial, and other

qualitative and quantitative factors.

•

Head and Shoulders Pattern: A chart pattern

characterized by three peaks, with the middle

being the highest (head) and the other two

lower and approximately equal in height

(shoulders), often indicating a bearish reversal.

•

Inverse Head and Shoulders: The opposite of the

Head and Shoulders pattern, featuring a central

trough (head) flanked by two shallower troughs

(shoulders), typically indicating a bullish reversal.

•

Market Sentiment: The overall attitude of

investors towards a particular security or

financial asset.

Neckline: In chart patterns like Head and

Shoulders, a line drawn across the lowest points

of the two troughs (in a standard pattern) or

peaks (in an inverse pattern) serves as a key

level for confirming trend reversals.

•

Resistance Line: In technical analysis, a price level

at which a rising asset tends to stop or reverse its

upward trend.

•

Rising Wedge: A bearish chart pattern where

both support and resistance lines slope upwards,

with the support line rising more steeply,

indicating a potential reversal from an uptrend

to a downtrend.

•

RSI (Relative Strength Index): A technical

indicator used in the analysis of financial

markets. It is intended to chart the current and

historical strength or weakness of a stock or

market based on the closing prices of a recent

trading period.

•

Stop-Loss Order: An order placed with a broker

to buy or sell once the stock reaches a certain

price, used to limit a trader's losses on a position.

•

Support Line: In technical analysis, a price level

at which a falling asset tends to stop or reverse its

downward trend.

•

Symmetrical Triangle: A neutral chart pattern

formed by the convergence of a downward-

sloping resistance line and an upward-sloping

support line, indicating a breakout in either

direction.

•

Technical Analysis: A trading discipline employed

to evaluate investments and identify trading

opportunities by analyzing statistical trends

gathered from trading activity, such as price

movement and volume.

•

Trend Reversal: A change in the direction of the

price movement of an asset or a market.

Glossary

Triangles and Wedges Article

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 17

Unlock Your Trading Potential with

Lan Turner's Technical Analysis Course

•

Personalized Learning: Get three hours of one-on-one instruction with Lan

Turner, a seasoned trading veteran.

•

Deep-Dive into Technical Analysis: Master mathematical indicators,

Fibonacci Projections, and Elliot Wave theory.

•

Advanced Strategies & Practical Skills: Learn to identify setups, manage

trades, and make strategic exits.

•

Flexible & Comprehensive: Six in-depth pre-recorded lectures with

additional private Q&A sessions to fit your schedule.

•

Dozens of Recorded Trade Examples: Gain practical insights with a

wealth of real-world trade scenarios, illustrating key concepts and strategies.

•

Exclusive Access: Direct communication with Lan Turner for personalized

educational guidance.

•

Special Offer: Enroll now for only $499.

o

Exclusive Discount: Use coupon code: PITMAG to enroll for just $199.

o

Save $300: Get three hours of personalized one-on-one instruction, and

deep-dive into technical analysis with Lan Turner personally.

"Trading is like playing chess. Most know how all the pieces move,

but few master the game. Let me teach you some

winning strategies." – Lan Turner

Register by phone: 435-752-8026

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 18

Behind the Trades: Deion Mitchell’s

Approach to Trading Options

by Deion Mitchell

It was a rainy Tuesday in late October, back in 2007,

when I found myself at the Chicago Board of Trade’s

Education Center, there to deepen my

understanding of the markets. Yet, as the raindrops

played a rhythmic cadence against the windows, my

focus drifted away from the trading screen. Outside,

the city was a blur of rain, each droplet distorting

the bustling scene into a watercolor of urban life.

Lost in this mesmerizing view, I barely noticed when

Lan Turner, my mentor and the closest thing I had to

a teacher in this cutthroat world of trading,

approached. With his sharp, enigmatic demeanor

that was as intriguing as it was slightly intimidating,

he leaned over, pulling me back to reality, and

asked, "Ever heard of options trading, Deion?" His

tone laced with the thrill of a challenge and the

wisdom of experience.

Lan Turner wasn’t much older than me at the time,

but his presence always commanded respect, much

like the key character from a John Grisham novel

—enigmatic, astute, and always three steps ahead.

"Do you ever feel like you're playing chess with only

half the pieces?" His question caught me somewhat

off guard, but as I pondered it, I realized he was

hinting that something was missing from my current

trading strategy.

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 19

This moment marked the beginning of my journey

into options trading. Lan introduced me to this new

world with practical examples and theoretical

insights. His distinctive method of simplifying

complex concepts truly captivated me. Lan had a

knack for unraveling the intricacies of options

trading, presenting them in a unique and intuitive

way. He could distill the essence of complex

strategies into clear, manageable and simple ideas,

making the formidable world of options seem so

much more accessible and less daunting.

As I delved into his teachings, I remember oscillating

between feeling overwhelmed and utterly

fascinated. Each session was like peeling back layers

of a mystery, revealing the core principles in a way

that was both enlightening and inspiring. His

approach was not just about imparting knowledge;

it was about changing the way I perceived and

thought about the markets. This shift in perspective

was crucial, as it laid the groundwork for the deep

understanding and strategic thinking that would

become the hallmark of my new approach to

trading. But his simple question sparked a curiosity

in me that I hadn't felt since my first day of trading.

Something was alluring about how he framed

options—a world filled with possibilities, risks, and

rewards that seemed to stretch beyond the

boundaries of traditional trading.

As I explored this new realm, I realized that options,

while often mentioned in the same breath as stocks

and futures, are fundamentally a different beast.

Each operates in its own unique way, offering

distinct advantages and carrying particular risks. My

journey to understand these differences wasn't just

about mastering new trading instruments; it was a

voyage of self-discovery, pushing my boundaries,

and learning to thrive in uncertainty.

In this article, I invite you to walk with me through

the high-stakes, adrenaline-pumping world of

trading. We'll unravel the mysteries of stocks, options

and futures, exploring how they differ and why these

differences matter. From the nerve-wracking

moments of day trading, making split-second

decisions, to the triumphant highs of successful

options trades, this narrative aims to enlighten and

inspire. Whether you're a seasoned trader or a

curious new onlooker, there's a thrill for everyone.

So, fasten your seatbelts and prepare for a journey

through the twists and turns through the world of

trading, where every decision can be as suspenseful

as the climax of a legal thriller. Welcome to the

world of options through my eyes, Deion Mitchell.

The real turning point in my understanding came

when, under Lan's guidance, I executed my first

options trade. It was a simple call option, based on a

well-thought-out market prediction. The thrill of

watching the option's value fluctuate with the

market movements was exhilarating. It was akin to

discovering a new superpower, one that allowed me

to harness market trends in ways I hadn't imagined

possible before.

As I dove deep into options trading, I started

realizing its potential. It wasn't just about buying

calls in uptrends, and puts in down, but crafting

intricate strategies to capitalize on market stability,

volatility, and even sideways movements. Realizing

that options could be used not just for speculation

but also for hedging existing positions opened my

eyes to a whole new spectrum of trading.

This revelation was empowering. I soon began to

embrace the intricacies of options trading, finding

beauty in its complexity and excitement in its

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 20

potential. The world of options was no longer a

daunting labyrinth of risks and jargon

but a landscape brimming with opportunities and

challenges.

During this phase of my journey, I transformed from

a cautious observer into an active participant. Each

trade, each strategy added to my understanding

and appreciation of my powerful new trading tool.

Understanding Options: The Basics

Options trading, at its core, is about choices and

possibilities. Imagine standing at a crossroads where

each path represents a different future for an

underlying asset, such as a stock. An option is

essentially a key that gives you the right to choose

one path or the other, but not the obligation.

Here’s how I think about options. There are two

primary types: call options and put options. A call

option is like holding a golden ticket that allows me

to buy an asset at a predetermined price within a

specific timeframe. This ticket becomes valuable if

the asset's market price soars above my locked-in

purchase price. Conversely, a put option is akin to

having an escape hatch that lets me sell an asset at

a specified price, regardless of how low the market

price falls.

Options are contractual agreements, but unlike a

straight up stock, or futures purchase, they offer the

flexibility to walk away if the market doesn't move

in your favor. This flexibility is a significant part of

the allure of options trading. The cost of this

flexibility is the option premium - a fee

we pay for the privilege of having the choice, much

like buying a movie ticket. We have the choice to

go see the movie, but not the obligation.

The Allure of Options

What drew me to options trading, which continues

to fascinate me today, is their incredible versatility.

Unlike stocks, or futures, where you're locked into a

contract to buy or sell an asset at a predetermined

price, options provide the ability to tailor strategies

to any market outlook, whether bullish, bearish, or

neutral.

Options trading is like playing a multifaceted game

of chess. Each move - whether it's buying a call,

selling a put, or constructing complex multi-leg

strategies - opens a world of possibilities. You can

design strategies that profit from market upswings,

downswings, and even periods of little to no

movement. This flexibility to adapt to any market

condition is not just exciting; it's empowering.

Moreover, options provide a level of leverage that

can amplify returns. You can control a significant

amount of the underlying asset with a relatively

small investment (the premium). This leverage must

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 21

be used judiciously, as it can amplify losses as well,

but it opens the door to opportunities requiring

significantly more capital in other forms of trading.

The beauty of options lies in their ability to cater to

different risk appetites. They can be used to

speculate with a high-risk, high-reward approach, or

to hedge and protect existing positions, offering a

safety net in volatile markets. This dual nature

makes options a versatile tool in any trader's arsenal.

My initial foray into options trading was driven by

curiosity, but it was the depth, flexibility, and

strategic complexity that transformed that curiosity

into a lasting passion.

The Thrill of Options on Futures

In the world of trading, options and futures often

dance in the same ballroom, yet they follow different

rhythms. The best way to illustrate this is through a

narrative from my own trading journey, one that

starkly highlights their contrasting natures.

It was during the early days of my foray into options.

Take, for instance, a time when the Crude Oil

market was highly volatile and I had purchased

several long contracts in the futures market.

However, Lan's insistence on the importance of risk

management rang in my ears, so I bought several

put options.

I recalled a lesson from Lan where he likened risk

management in trading to auto insurance. In options

trading, the premium paid for the option is like an

insurance policy. If the market turns against us, our

loss is limited to the 'deductible' in this analogy – the

difference between where we entered the market

long, and where we purchased our put. While any

additional losses are then 'covered' by the profits

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 22

from the option. When paying our car insurance; we

don't lament the monthly premiums just because we

didn't have to make a claim, which would imply an

accident. This strategic use of options for risk

limitation has become a cornerstone of my trading.

Within weeks, Crude Oil took a sharp downturn. My

portfolio suffered significant losses, but the put

options I purchased soared in value. This strategic

move effectively insulated my overall position from

a substantial financial blow. It was a profound lesson

on the importance of hedging and risk management

- a lesson that was as thrilling as it was educational.

Risk management is not just a protective strategy;

it's an integral part of a trader's arsenal. Whether

trading options, where the risk can be limited to the

premium paid, or buying into a stock, or a futures

contract, where the risk can be much higher.

Understanding and managing risk is about

anticipating twists, preparing for the unexpected,

and ensuring that the story has a favorable ending,

regardless of the market's unpredictable nature.

Realizing the Power of Delta

The climax of my trading story occurred when I

discovered the transformative power of delta in

options trading. This was my 'eureka' moment, a

revelation that completely changed my approach to

trading.

Delta, in the world of options, is akin to a compass

guiding a ship through the tumultuous sea of the

market. It represents the rate at which the price of

an option changes relative to a one-point

movement in the price of the underlying asset. In

simpler terms, delta indicates how much the value of

an option is expected to increase or decrease with

every dollar movement in the underlying stock.

To illustrate, imagine delta as the sensitivity of an

option to the movements of the stock it's based on. If

an option has a delta of 0.5, it means that for every

$1 change in the stock price, the option's value will

change by .50 cents. This little number, seemingly

innocuous, became the cornerstone of my trading

strategy.

The pivotal point came during a particularly volatile

market phase. I had a portfolio of diverse options,

and it was becoming increasingly challenging to

predict how each would react to market changes.

That's when Lan Turner introduced me to the

strategic use of delta. He showed me how to

interpret delta not just as a measure of price

sensitivity but as a tool for predicting the likelihood

of an option ending in the money.

Understanding delta transformed my approach to

options trading. Instead of merely speculating on the

direction in which the market would move, I began

to incorporate delta into my strategy, selecting

options with the right delta values that aligned with

my market predictions and risk tolerance. For

instance, in a bullish market, I look for call options

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 23

with a higher delta, indicating a greater likelihood of

profitable movement with the stock. Conversely, in

bearish conditions, options with lower delta values

became my go-to, as they are less sensitive to

negative movements in the stock’s price.

This approach allowed me to tailor my options

portfolio with a more nuanced understanding of risk

and potential reward. It was no longer about

making blanket predictions; it was about making

calculated, informed decisions based on the behavior

of delta. This knowledge enhanced my ability to

profit in favorable conditions and helped me

mitigate losses during market downturns.

In essence, realizing delta's power was a defining

moment in my trading career. It elevated my

strategies from simple speculation to informed, data-

driven decision-making, much like a seasoned

lawyer using critical evidence to turn the tide in a

high-stakes legal battle.

Personal Growth and Lessons Learned

As my trading journey moves forward, it's essential

to reflect on the personal growth and the invaluable

lessons learned along the way. Trading, particularly

in options and futures, has been more than just a

profession; it's been a constant learning, adapting,

and evolving journey.

Reflective Insights

One of the most profound insights gained is the

understanding that trading is not merely about

financial gain but about the discipline of the mind

and the management of emotions. The markets are

unpredictable, often volatile, and always

challenging. Learning to navigate them requires not

just technical knowledge but also psychological

resilience. The highs and lows in trading are akin to

the suspenseful twists in a novel — they test your

patience, strategy, and ability to stay calm under

pressure.

Key Lessons

Among the most important lessons learned is the

significance of risk management. In stocks, futures,

and options trading, risk management is not just a

part of the strategy; it is the strategy. Each decision,

each trade, and each investment must be weighed

not just for its potential profit but also for the risk it

carries. This approach has instilled in me a sense of

prudence and respect for the markets.

Another critical lesson is the importance of

adaptability. The markets are ever-changing, and a

strategy that works today may not work tomorrow.

Being successful in trading means being flexible,

continuously learning, and being willing to adjust

strategies in response to market dynamics.

Lastly, the journey underscored the value of

mentorship and collaboration. Learning from Lan

Turner and interacting with other traders provides

me with a perspective that is instrumental in shaping

my trading approach. It taught me that while

trading can be solitary, the knowledge and

experiences shared within my trading community

are invaluable.

As my story nears its conclusion, these reflections and

lessons form the essence of my trading philosophy.

They are not just strategies for financial success but

guiding principles for personal and professional

growth in this unpredictable and exhilarating world.

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 24

The Moral of the Story

As we reach the conclusion of this narrative — much

like the final pages of a John Grisham thriller where

the plot resolves and the lessons emerge — it's time

to distill the essence of my trading adventure.

My journey into options and futures trading has

been more than a series of financial transactions; it’s

a journey of discovery, learning, and personal

development. The key takeaways from my

adventure are many, but here are five:

1.

Understanding Is Key: Mastery of concepts like

delta in options trading can transform your

approach from speculative to strategic.

2.

Risk Management Is Crucial: Whether in stocks,

or futures, understanding and managing risks is

not just part of the strategy; it is the strategy.

3.

Flexibility and Adaptability: The markets are

ever-changing, and success lies in adaptability

and responsiveness to these changes.

4.

The Power of Mentorship: Learning from

experienced traders can provide invaluable

insights and accelerate your learning curve.

5.

Psychological Resilience: Trading is as much a

mental game as a financial one, requiring

patience, discipline, and emotional control.

To those readers intrigued by the world of options

trading, I encourage you to continue your

exploration of these fascinating markets. Remember,

every expert was once a beginner. Start with the

basics, seek knowledge, and don't hesitate to ask for

guidance.

Parting Wisdom

As a parting piece of wisdom for aspiring traders, I

leave you with this thought: Trading is not just about

pursuing profit; it's a journey that tests and builds

character. It teaches applicable lessons beyond the

trading floor — about decision-making, managing

uncertainty, and continuous learning.

In the world of trading, every challenge is an

opportunity for growth, every loss a lesson, and every

success a testament to perseverance and strategy.

Embrace the journey with curiosity, resilience, and an

open mind.

Deion Mitchell is a part-time trader, Lan Turner's

President's Club member, and contributing writer to

PitNews Magazine; Mr. Williams is a retired

aeronautical space engineer from Lockheed Martin

Skunk Works.

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 25

1.

Options: Financial derivatives that give the

buyer the right, but not the obligation, to buy

(call option) or sell (put option) an underlying

asset at a specified price within a certain

timeframe

2.

Call Option: A type of option that gives the

holder the right to buy a specific quantity of an

underlying asset at a predetermined price

(strike price) before a specified expiration date.

3.

Put Option: A type of option that gives the

holder the right to sell a specific quantity of an

underlying asset at a predetermined price

before a specified expiration date.

4.

Futures: Financial contracts obligating the buyer

to purchase and the seller to sell, a specific asset

at a predetermined future date and price.

5.

Delta: A measure of an option's sensitivity to

changes in the price of the underlying asset. It

indicates how much the price of an option is

expected to move per $1 change in the price of

the underlying asset.

6.

Premium: The price paid for purchasing an

option. It represents the cost of acquiring the

right to buy or sell the underlying asset.

7.

Risk Management: The process of identification,

analysis, and mitigation or acceptance of

uncertainty in investment decisions.

8.

Hedging: A risk management strategy used to

limit or offset the probability of loss from

fluctuations in the prices of commodities,

currencies, or securities.

9.

Leverage: The use of various financial

instruments or borrowed capital, such as

margin, to increase the potential return of an

investment.

10.

Strike Price: The set price at which a derivative

contract can be bought or sold when it is

exercised.

11.

Expiration Date: The date on which a derivative

contract (such as an option or futures) expires,

and the rights to exercise it cease to exist.

12.

In-the-Money: A term used to describe an

option contract that has intrinsic value - for a

call option, when the underlying asset's price is

above the strike price and for a put option,

when the underlying asset's price is below the

strike price.

13.

Out-of-the-Money: An option that has no

intrinsic value - for a call option, this is when the

underlying asset's price is below the strike price,

and for a put option, when the underlying

asset's price is above the strike price.

Technical Appendix - Glossary

This technical appendix provides definitions for some of the key terms used throughout Deion’s

article, offering readers a clearer understanding of the concepts discussed in the narrative of

stocks, options, and futures trading.

History Continually Repeats Itself, Over & Over & Over.

The KEY is Knowing When That Might Happen Again!

www.TradeMinerPro.com

TradeMiner

Market Data Miner

Find the right stock-futures

to trade at the right time

www.TradeMiner.com

Scans & Finds Historically Repeating Market

Cycles and Trends

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 26

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 27

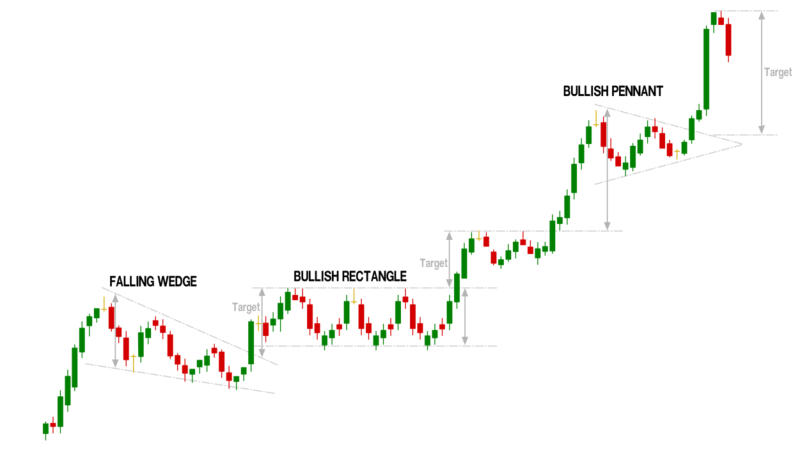

Mastering The Christmas Tree

And Balaam’s Ladder Trading Strategies

by Claire Kristensen, co-Author Aiden Gray

When I first dipped my toes into the trading world, I

quickly learned that timing was everything—yet it

was as elusive as capturing lightning in a bottle.

Whether I was jumping in too early or too late, I

often found myself lamenting missed opportunities.

This led me to revisit Lan Turner's book, focusing on

two methodologies: The Christmas Tree and

Balaam's Ladder.

My Journey Into Dollar Cost Averaging:

Mr. Turner's unique Christmas Tree approach to

dollar cost averaging has become my preferred

method for market entry. I begin by cautiously

entering a long position rather than committing fully

from the start. When the market moves against me,

I place buy limit orders at strategic levels, viewing it

as an opportunity to improve my entry price and

systematically increase my position size.

The "Christmas Tree Trading Strategy" might not

bring about a white Christmas, but it could very well

green up your portfolio. Named for its visual

representation in the Track 'n Trade trading

platform, where a series of green buy limit orders

seem to hang like ornaments on a festive tree; this

strategy focuses on a calculated, incremental

approach to market entry.

This approach effectively lowers my average entry

cost, positioning me for higher potential profits when

the market rebounds.

Exploring Balaam's Ladder.

As I gained confidence and honed my skills, I became

interested in Balaam's Ladder, the counterpart to

the Christmas Tree strategy.

'

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 28

‘Balaam's Ladder' offers a strategic approach to

capturing profits in a bullish market turn. Visually

represented in the Track 'n Trade trading platform

by a series of ascending red sell limit orders, akin to

climbing a fiery ladder, this strategy carefully builds

a short position as the market rises. Each red limit

order, symbolizing a step on the devil's ladder,

incrementally adds more shares or contracts,

elevating the short position's dollar cost average.

Aptly named for its devilish play on risk, as there's no

definitive peak to a rising market. Balaam's Ladder

embodies the daring yet calculated approach of

engaging with an endlessly ascending market, a

venture that requires both courage and caution.

I design my sell limit orders to gradually build short

positions. This strategy is particularly effective when I

anticipate a market’s peak. It lets me benefit from

the trend's downward movement without

pinpointing the exact top.

Instead of cannonballing into a position, you initially

buy when bullish, or sell when bearish a fraction of

your target, perhaps 250 shares out of a planned

1,000, or one contract in the futures market out of

five. As the market moves against you, you

strategically add more shares or contracts to your

position until you've reached your maximum

allocated share size or your predefined exit stop is

triggered.

BUY 1 MARKET / STOP

SELL 3 LMT

SELL 1 LMT

BUY 1 LMT Add on

BUY 2 LMT Add on

BUY 3 LMT Add on

BUY 4 LMT Add on

BUY 5 LMT Add on

SELL 16 STOP / EXIT

The Christmas Tree

Alternatively:

Start with 1,

add 1

add 1

add 1

add 1

add 1

stop 6.

Or

Start with 1,

add 1

add 2

add 4

add 8

Stop 16.

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 29

In contrast to "Cannonballing," where a trader jumps

in with the full position size upfront, the Christmas

Tree and Balaam’s Ladder employ a technique akin

to "dollar cost averaging." Dollar-cost averaging is

where you invest a fixed dollar amount in a specific

asset at regular intervals, regardless of its price.

However, with the Christmas Tree and Balaam’s

Ladder Strategies, we're not strictly sticking to

regular intervals but adapting to market conditions.

If the market moves unfavorably, you can improve

your average entry price by adding to your position

at a better price.

The Christmas Tree and Balaam’s Ladder turns what

many might see as a market setback into a strategic

opportunity. By purchasing additional shares or

contracts at lower, or higher prices respectively, you

effectively reduce your average entry cost, which can

ultimately enhance your profit potential when the

market swings back in your favor.

The Mechanics of the Christmas Tree

How to Initiate a Position with a Smaller Share Size:

1.

Identify Market Entry Point: Start by

determining your desired entry point in the

market based on your analysis. Let's say you've

set your eyes on a stock currently trading at $50

per share.

2.

Decide on Position Size: Next, decide on your

total desired position size. For example, you

might aim for a full position of 1,000 shares.

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 30

However, instead of buying all at once, the

strategy calls for starting smaller—perhaps with

250 shares.

3.

Place Initial Order: Place a buy limit order for

250 shares at or near your determined entry

point. This fractional size allows you to test the

waters without fully committing.

Strategy for Adding More Shares if the Market

Moves Against You:

1.

Set Additional Buy Limit Orders: Pre-determine

price levels at which you will add more shares if

the stock moves against your initial position. For

instance, you could set subsequent buy orders at

$49, $48, and $47.

2.

Size Increments: Decide on how many

additional shares you will buy at each

subsequent level. You could continue with

increments of 250 shares, or adjust based on

your risk tolerance and strategy, doubling up

the incremental number of shares, which brings

your dollar cost average down more quickly.

3.

Max Position & Exit Strategy: Know your

maximum position size in advance (e.g., 1,000

shares in this example) and have a firm exit

strategy. Set a stop-loss order to trigger if the

market continues to move against you beyond

a point that you're comfortable with.

4.

Reassess & Adjust: As your additional orders get

filled, constantly reassess your position. Calculate

your new average entry price and adjust your

stop-loss orders accordingly.

5.

Take Advantage of Market Swings: The goal is

to improve your average entry cost as the

market moves against you, so that when the

trend reverses in your favor, you are positioned

for a more profitable exit.

In this example, the Christmas Tree Strategy has

allowed you to enter the market in a more risk-

managed way, and you were able to benefit when

the market turned in your favor.

The Roll: Implementing the 'Roll': In navigating the

ups and downs of the market, I've adopted Lan

Turner’s technique he calls 'the Roll’.

The Concept of the Roll:

There are moments in trading when, despite best

efforts at strategic entry, the market continues to

trend against my position. In such scenarios, as my

position size grows, so does my exposure to risk. This

is where the Roll becomes crucial. The objective of

the Roll is to reduce risk in a position that has grown

uncomfortably large due to continued adverse

market movement. (Catching a falling knife.)

Executing the Roll:

The Roll strategy is executed at the first suitable

opportunity, typically at a point where the losses are

minimized or, ideally, when the market rebounds to

a breakeven level. At this juncture, I liquidate a

substantial portion of my position. This action

effectively reduces my exposure and risk, providing a

safety net if the market trend continues to oppose

my initial analysis.

The Roll is not just about cutting losses; it's a

proactive move to safeguard against potential

further downturns. It's an acknowledgment that

while the market may still turn in my favor, the

current extended position may carry more risk than

initially planned.

Strategic Consideration for the Roll:

1.

Risk Assessment: Before executing the Roll, I

assess the current market situation and the size

of my position in relation to my overall risk

tolerance.

2.

Decision Point: I choose a point for the Roll

based on technical indicators or a return to a

near breakeven level.

3.

Position Adjustment: I then swiftly reduce my

position size, thereby decreasing my exposure

and potential downside risk.

4.

Readiness to Re-engage: Post-Roll, I remain

vigilant and ready to re-enter the market or

continue dollar cost averaging from this new,

more secure position again, waiting for market

conditions to change favorably.

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

Page 31

The Benefit of the Roll:

The Roll offers a cushion against the unpredictability

of market movements. By reducing the position size

during times of adverse market trends, I retain the

flexibility to manage my trades more effectively and

maintain control over my risk exposure. The Roll is

an integral part of my trading approach, ensuring

that I am prepared for various market scenarios,

always prioritizing capital preservation.

Risk Management: I want to stress the Importance of

a well-defined exit strategy.

1.

Purpose: An exit strategy serves as your safety

net, guiding you on when to cut losses or take

profits. It's not just about knowing where to

enter; it's equally, if not more, crucial to know

where to exit.

2.

The Roll: In my trading experience, I've honed

the Roll strategy to such a degree of

effectiveness that in many instances, I've

managed to bypass the need for stop orders to

exit my positions altogether. By consistently

implementing the Roll, I’ve been able to

continually adjust my trades, effectively

avoiding large losses or excessive risks.

By marrying the mechanics of the Christmas Tree

with Balaam’s Ladder with stringent risk

management protocols, including stops and the Roll,

we, as traders can seek to optimize our market

entries while safeguarding against excessive losses.

Advantages: Risk Mitigation

1.

Staggered Entry: By incrementally entering the

market, the Christmas Tree Strategy to the long

side, and Ballam’s Ladder to the short side,

allows you to spread the risk associated with an

ill-timed single entry point. If the market moves

against you, your initial loss is limited to the

smaller share size you started with.

Disadvantages: The Potential for Large Losses

1.

Incremental Risk Exposure: While the strategy

allows for risk mitigation, it simultaneously

exposes traders to incremental risk. As you add

more shares to your position, you are essentially

'doubling down' on a losing trade, which can

backfire if the market continues to move

against you.

2.

Irrational Markets: Remember, markets can stay

irrational longer than you can stay liquid, and

this has never been more true than when

trading the Christmas Tree and Balaam’s

Ladder strategies.

Automated trading systems may execute trades at

lightning speed, but they lack the intuitive sense of a

skilled trader. Both of these strategies involve a form

of market 'intuition'—knowing when to add to or

reduce your positions is an art as much as it is a

science.

There are numerous variations of the Christmas Tree

and Balaam’s Ladder strategies, and what we’ve

discussed so far only covers the basics. I encourage

you to use your imagination and creativity to

explore these strategies further. A great way to do

this is by watching Lan Turner’s educational trade

example videos, where he demonstrates several

variations himself, then practice in a demo account,

which allows you to expand your capabilities and

understanding without financial risk.

Incorporating these strategies into my trading toolkit

has marked a significant step towards becoming a

more adaptable and resilient trader. These are not

just methods but tools for navigating the ever-

changing landscape of the markets, helping me to

develop a versatile approach to my trading journey.

I hope they do the same for you.

Claire Kristensen is a part time futures trader and

stock investor living in Las Vegas Nevada. She’s a

member of Lan Turner’s President’s Club, and a

contributing writer to PitNews Magazine.

Ready to take your trading to the next level?

Dive into Track 'n Trade with a free trial.

Track ‘n Trade LIVE Stocks & Futures

The Ultimate STOCKS, FUTURES & OPTIONS Live Trading Platforms

Live Trading Platforms For The Visual Investors

www.TrackNTrade.com

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

The Great YouTube Trader:

Don’t Get Bamboozled

by Lan Turner

The rise of YouTube as a platform for traders to

share their strategies has significantly changed the

game for investors and traders. Many traders have

gained a following by promising easy profits and

showing off their trading successes. These videos often

showcase large profits and bold market predictions,

which can entice both beginners and seasoned

traders.

Yet, these online trading celebrities can be a double-

edged sword. The promise of quick wealth and

overnight trading success can mislead new traders.

Some YouTubers may use editing tricks and selective

live sessions to create an illusion of infallible trading

strategies, which doesn't reflect the true nature of

the risky and uncertain financial markets.

This article will give you the knowledge to tell the

difference between actual trading skills and deceit.

We'll uncover the subtle cues that indicate whether a

YouTube trader is legitimately skilled or if you're

seeing a performance meant to mislead. We intend

to create an informed community that can

approach the world of financial trading with a

critical eye, avoiding scammers and valuing genuine

education and insight.

The Tale of Two Accounts:

There's a deceptive practice that some high-profile

YouTube traders are engaging in. It's being exposed

by regulatory crackdowns where trading "gurus"

maintain multiple separate trading accounts—one

for long positions and the other for shorts. As the

market fluctuates, they wait for one account to show

a profit. That's the account they then broadcast to

their audience, creating the illusion of a one-sided

winning streak.

Page 33

Disclaimer: There is a chance of loss when trading Stocks, Futures and Options.

See full risk disclosure online at: PitNews.com/risk.htm Copyright © PitNews Press, Inc.

The red flags of this scheme are subtle but telling.

The most significant is the lack of transparency in

placing orders. If a trader frequently executes trades

off-screen, it's a sign of likely

manipulation. Additionally, suppose

live trades seem haphazard, and

trades don't align with their stated

strategies or past patterns. In that

case, it suggests that viewers might

only be seeing a selectively successful

narrative.

I've seen live trading gurus confidently

tell viewers the market was heading

down, providing detailed

explanations of their bearish outlook.

Pointing out projections, support

levels, and market liquidity. But then,

it turns out they suddenly had a big

winning trade off-screen, going the

other direction. Why talk up a bearish

market while quietly betting on a

price rise?

This kind of trickery breaches ethical standards and

distorts the reality of trading. It promotes a

dangerous misconception that trading is a surefire

win and downplays the inherent risks. This false

portrayal can lead novices to adopt similar reckless

tactics, often with costly outcomes, under the

misguided belief that this is standard trading

practice.

Deception in Action: The Case of 'Trader Jack”:

I stumbled upon “Trader Jack's” channel during one

of my late-night research sessions. Jack had a

confident air about him, and his trading sessions

were nothing short of mesmerizing. Each trade

seemed to end in a celebration of profits. The allure

was undeniable, and he had a knack for making it

all look so easy, so accessible. Jack's endorsements of

a particular brokerage firm were persistent, weaving

in calls to action and encouraging viewers to sign up

and trade as he did.

As I watched, something felt amiss. Jack's trades were

executed flawlessly, but the setup seemed peculiar.

Orders were often placed off-screen, and despite his

purported transparency, the execution of most of his

max-size entries were rarely visible. It was as if, by

magic, Jack's positions were always in the green.

It soon became apparent that Jack was playing a

game of digital sleight of hand. He secretly traded

multiple accounts on multiple monitors—one he'd

buy, the other he'd sell. The market's inevitable

swing in one direction or the other would turn one

account profitable. That's when Jack would pivot the

YouTube live screen-share, showcasing the success

while discarding the evidence of the losing trade,

hidden off-screen.